If you take any account, a bank account, an IRA. A 401(k) etc. it doesn't matter the obvious downside of most traditional accounts is taxation. The vast majority of accounts are taxed when the money comes out or like a mutual fund is taxed each year on the gains.

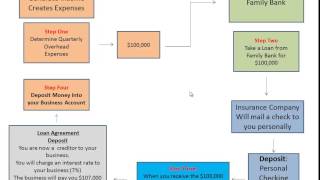

With the concept of the family bank, when you have $20,000 of cash value in the policy. You can then leverage or borrow $20,000 from the insurance company. That way you get to keep the $20,000 earning what ever the S&P 500 is going to earn that you never ever liquidate the $20,000 nor eliminate the potential compounding interest from the growth of the $20,000.

If you could keep all or most of the money you now pay in taxes and interest charges, the compounded effect of the savings would literally change your life; financial independence would become a foreseeable reality; and a myriad of options would open up for you and your family that today are only fantasies.

Shared 10 years ago

39K views

Shared 11 years ago

1K views

Shared 11 years ago

578 views